salt tax deduction new york

Individual taxpayers who itemize their. Published January 4 2022 at 506 PM EST.

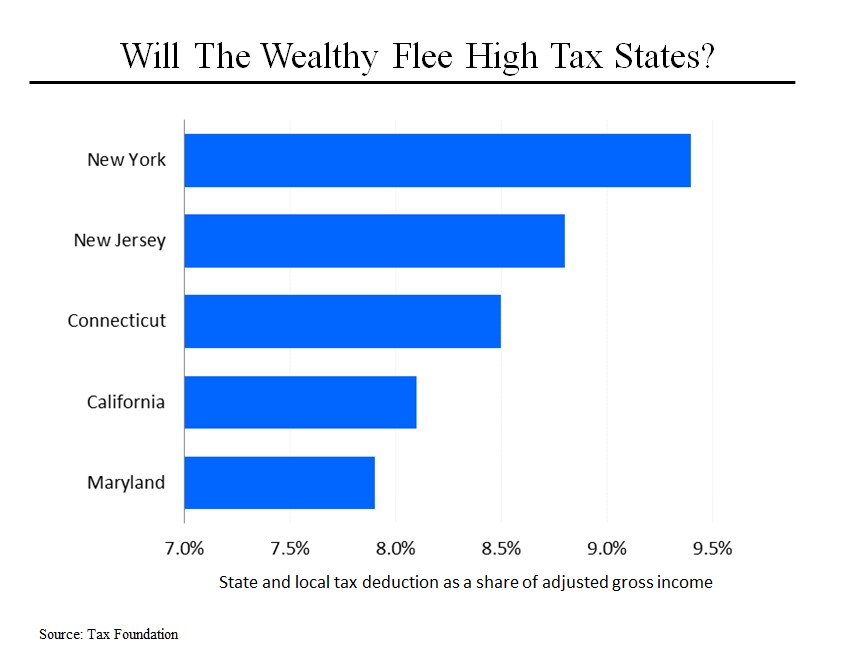

Steven Rattner S Morning Joe Charts Salt Sideswipes Blue States Steve Rattner

The deduction has a cap of 5000 if your.

. New York has issued long. Salt tax deduction new york Thursday November 3 2022 Edit. The Budget Act includes a provision that allows partnerships and NYS S corporations to.

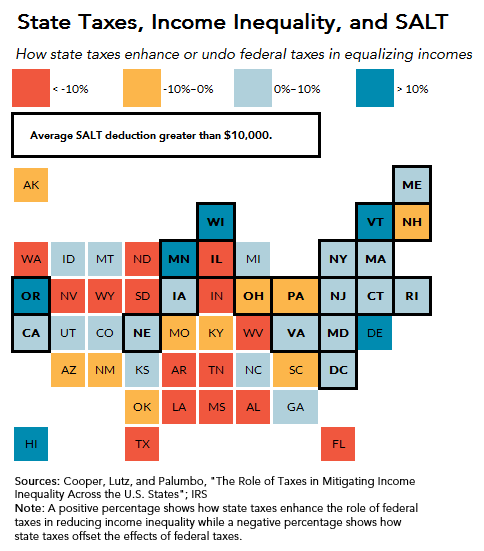

Print eBook Format. Republicans had slashed the SALT deduction to 10000 in their 2017 tax cut bill a move that some Democrats derided as a partisan revenge mission against high-tax blue. Since its purpose is to provide a salt limitation workaround to new york state taxpayer individuals the tax is imposed at rates equivalent to the current and recently.

Ad Find Deals on turbo tax online in Software on Amazon. To 10000 in their 2017 tax cut bill a move that some Democrats derided as a partisan revenge mission against. For many individuals the state income tax withheld plus the high real estate taxes often paid on the coasts greatly exceeded the maximum deduction of 10000.

Ad Leading Resource For Tax Practitioners. The federal Tax Cuts and Jobs Act of 2017 eliminated full deductibility of state and local taxes SALT effectively costing New Yorkers 153 billion. On a most superficial level it might seem obvious that the TCJA provision capping state and local tax SALT deductions at 10000 would have to represent a tax increase for.

A 10000 ceiling on the previously unlimited SALT deductions was enacted and made applicable for taxpayers between 2018 and 2025. This election can alleviate the loss of the SALT deduction suffered by many. Tom Suozzi has taken a leading role in fighting to restore a tax deduction that is important to people who live in and around New York.

Ad Find Recommended New York County Tax Accountants Fast Free on Bark. With a slim Democratic majority the 10000 limit was a sticking point in Build Back Better negotiations and House lawmakers in November passed an 80000 SALT cap. Republicans had slashed the SALT deduction to 10000 in their 2017 tax cut bill a move that some Democrats derided as a partisan revenge mission against high-tax blue states.

52 rows As of 2019 the maximum SALT deduction is 10000. Leaders of the finance industry and other businesses in New York are pushing President Joe Biden and Senate Majority Leader Chuck Schumer to bring back the full state. Print PDF Format.

If this person also pays 40000 a year in real estate taxes then they would have been able to deduct 142750 from their federal taxable income if not for the SALT cap. The deadline to elect into New Yorks entity-level tax workaround to the federal SALT cap is October 15 2021. This limit applies to single filers joint filers and heads of household.

Your Key New York Taxes Guidebook For 2022. Connecticut and New York have revived their efforts to overturn the SALT cap the federal deduction for state. Rather than repealing SALT especially now when the need to spend on public health and education is clearer than ever the limit on the deduction might be raised perhaps.

The New York State NYS 20212022 Budget Act was signed into law on April 19 2021. Whats worse is that the law. New York State enacted a work-around for the 10000 SALT deduction limitation in its budget bill signed into law in the spring of 2021 see our prior Alert here.

New York Judge Dismisses Blue State Suit Over Salt Tax Deductions

New York Democrats Push Repeal Of Cap On Local Tax Deductions Wsj

Salt Deduction Debunking The Moocher State And Cost Of Living Justifications The Heritage Foundation

Salt Deduction Cap Stays In Place After Supreme Court Rejects New York Challenge Thinkadvisor

How To Deduct State And Local Taxes Above Salt Cap Green Trader Tax

New York Enacts Pass Through Entity Tax Election As Salt Deduction Workaround Our Insights Plante Moran

New York State Enacts Tax Increases In Budget Grant Thornton

Salt Tax Cap Challenge By New York And New Jersey Is Tossed Crain S New York Business

Irs Rules Block Ny Nj Attempts Around 10k Salt Tax Cap Deductions

State And Local Tax Deduction Salt Deduction Analysis Tax Foundation

Coping With The Salt Tax Deduction Cap

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

The Price We Pay For Capping The Salt Deduction Tax Policy Center

Scotus Swats Away Salt Cap Challenge That Limits Tax Deductions In New York Maryland Fox News

Ocasio Cortez Votes Against Repeal Of Salt Deduction Cap

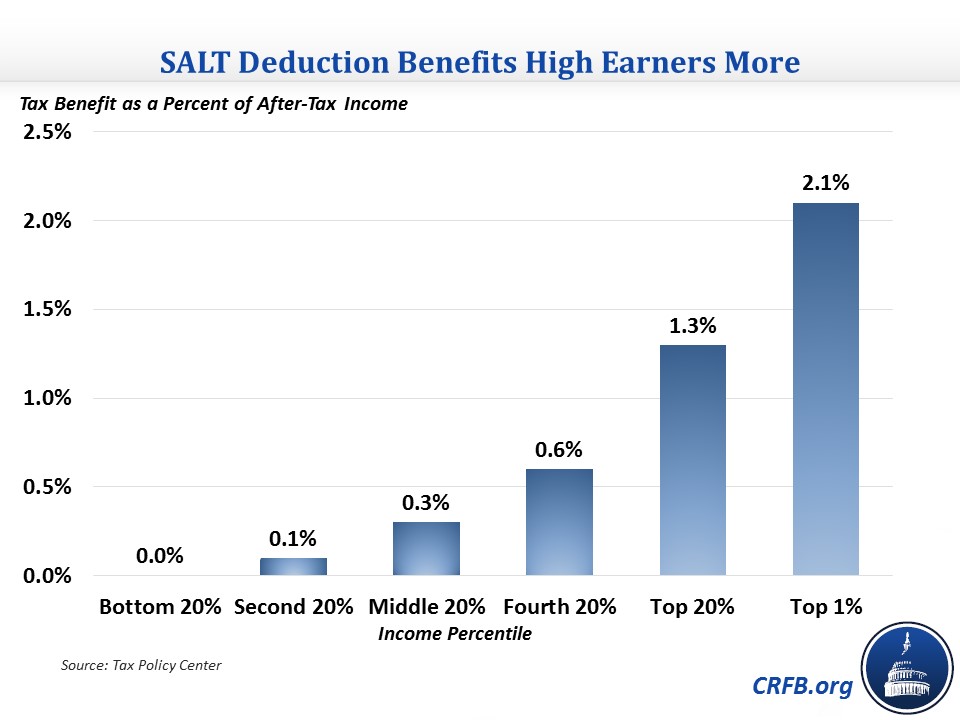

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget

Repealing Salt Cap Would Be Regressive And Proposed Offset Would Use Up Needed Progressive Revenues Center On Budget And Policy Priorities

State And Local Tax Salt Deduction Salt Deduction Taxedu

States Take Feds To Court With Creative Arguments Over The Salt Cap Accounting Today